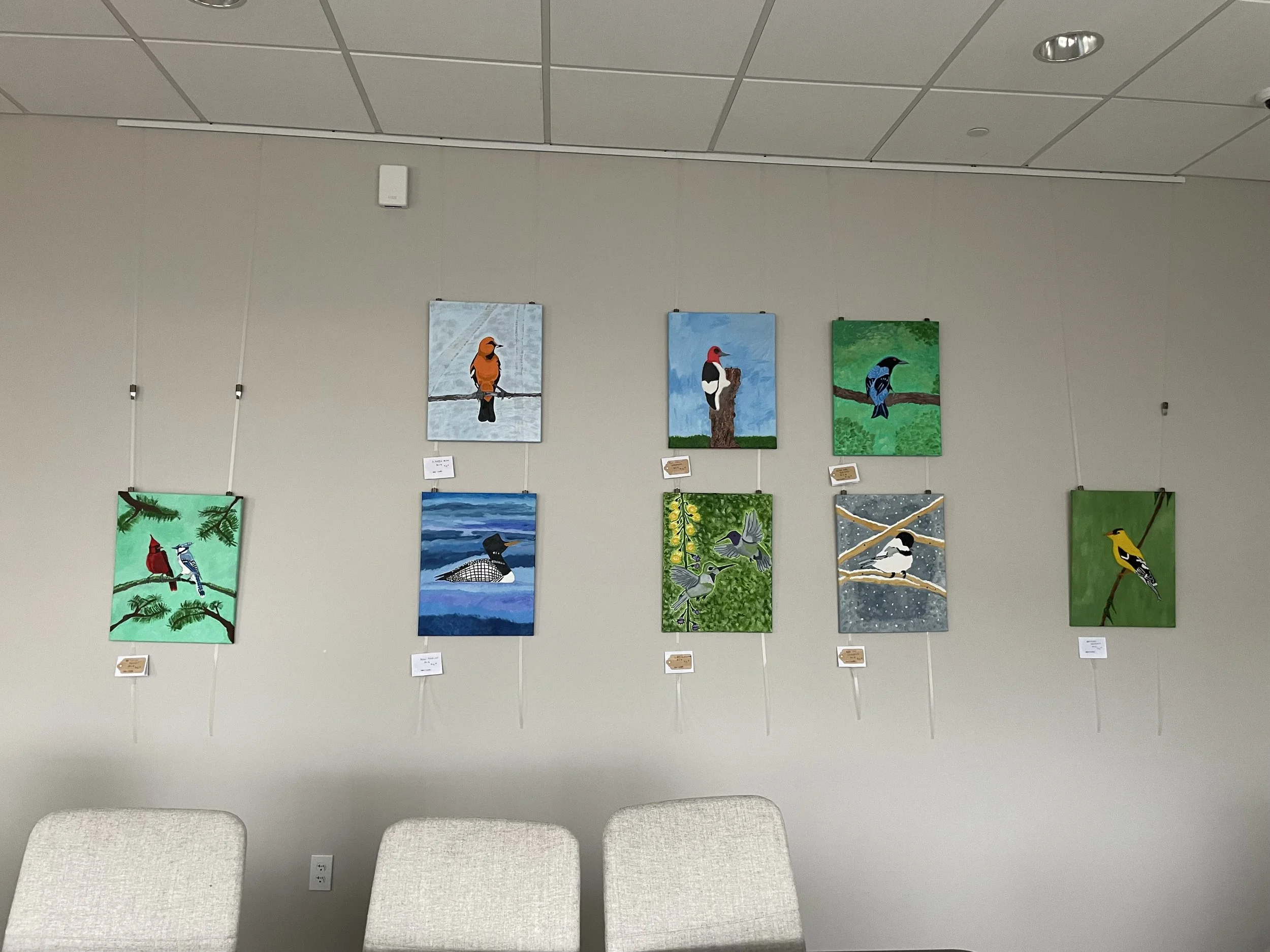

We are thrilled to open the doors of the Service One Community Meeting Room to a truly special show: an exhibit celebrating the amazing artists from The Buddy House of Southern Kentucky!

Read MoreMaximize your holiday season with SOCU's Q4 2025 newsletter! Find expert tips on smart budgeting, avoiding scams, and year-end financial planning. Read more now.

Read MoreHave you ever checked your credit score on a free credit monitoring tool and saw one number, but when you went to apply for a loan or credit card your score was actually an entirely different number? This is because there are different credit score model variants, but let's focus on the two most common models: the FICO Credit Score and the VantageScore. These scores are used to determine how likely you are to pay back money borrowed, or your “creditworthiness.”

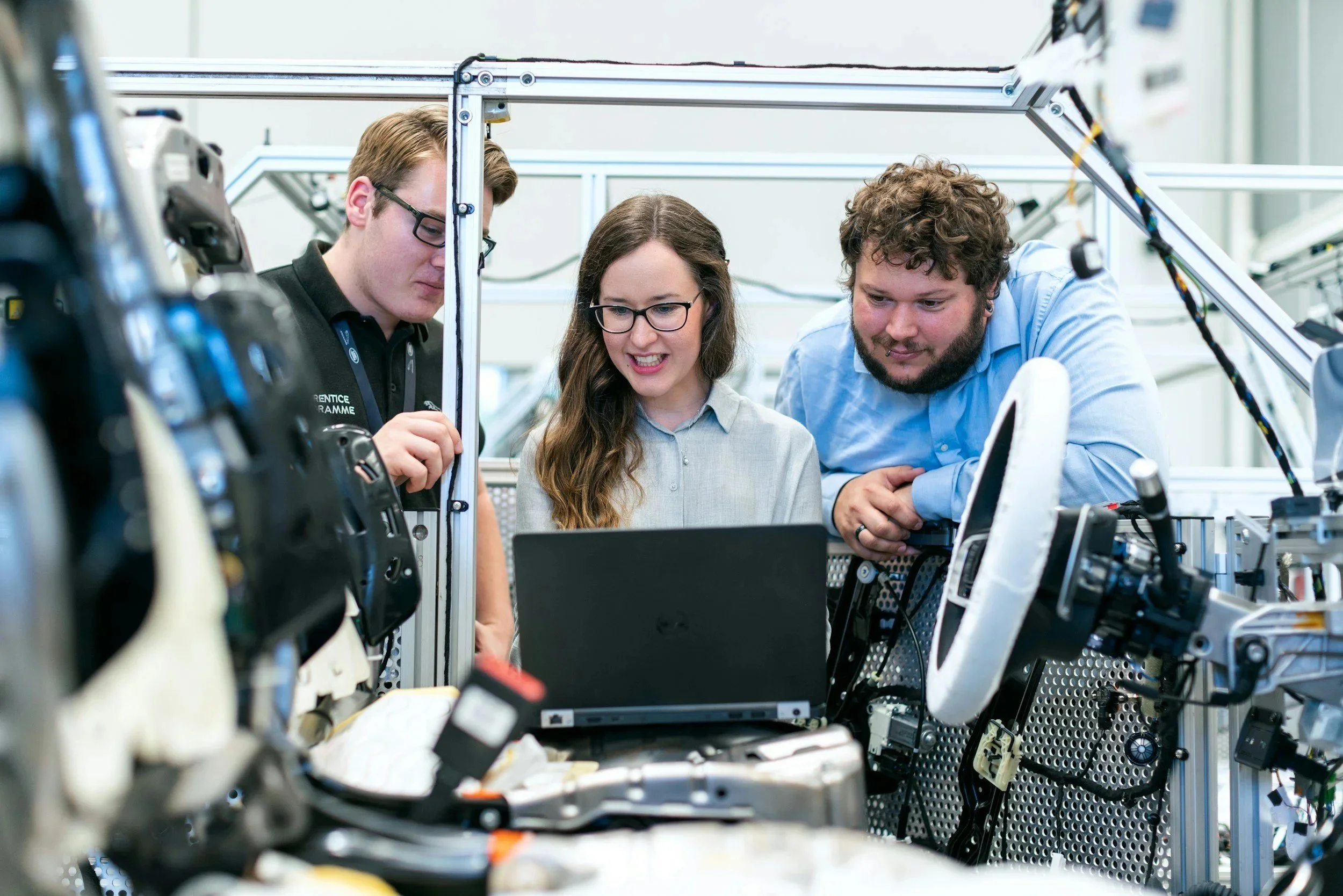

Read MoreA company's greatest asset is its people. That's why smart business decision-makers are increasingly looking for ways to invest in their teams beyond traditional benefits. At Service One Credit Union, we can help you do just that while also supporting your organization's financial goals.

Read MoreWhen it comes to financial partners, your business deserves more than a one-size-fits-all solution. You need a partner that understands the frustration of complex banking systems and recognizes that your company is made up of real people. That’s the Service One difference.

As a local credit union, we want our members—and our business partners—to know they are speaking with a real person. We’re committed to providing exceptional service and high-quality products , but we also believe in sounding approachable and relatable.

Read MoreFinancial stress is a real and significant challenge for employees across all industries. This stress can lead to lower productivity, higher absenteeism, and increased healthcare costs for your organization. But what if there was a way to improve your employees' well-being while also boosting your business’s bottom line?

Read MoreAs parents, we wear many hats: chef, chauffeur, storyteller, and increasingly, financial educator. Teaching our children about money management, saving, and smart spending is crucial for their future success. But where do you start? The good news is, you don't have to navigate this journey alone. Service One Credit Union offers a wealth of resources designed specifically to support your family's financial wellness, from their very first piggy bank to planning for college and beyond.

Let's explore some of the keyways Service One Credit Union can be your family's financial partner:

Read MoreStay informed with Service One Credit Union's Q3 Newsletter! Discover the latest updates, financial tips, community initiatives, and member highlights to help you achieve your goals. Explore how SOCU is making a difference for you and your community.

Read MoreProtecting your personal and financial information is more important than ever. Passwords alone aren’t enough anymore, especially when cybercriminals are constantly evolving their tactics. That’s where authenticator apps come in.

These small but powerful apps can make a big difference in keeping your accounts secure. Here's everything you need to know.

Read MoreA native of Knoxville, Tennessee, Karen Kidwell’s creative spirit began early in life. She graduated from Halls High School in 1977, where she majored in Art and Distributive Education (Marketing), planting the seeds of her artistic journey.

Her passion for creativity continued beyond high school, as she spent nine years taking part-time art and graphic design courses at Pellissippi Community College. Though she never completed the full curriculum, her commitment to art remained steady in the background as life carried her in different directions.

Read MoreKeeping your banking accounts and personal information safe is a top priority. You trust us with your finances, and we take that responsibility very seriously. In today's digital world, online security is more important than ever. That's why we want to talk about a powerful security tool called Multi-Factor Authentication, or MFA for short.

Read MoreStay informed with Service One Credit Union's Q2 Newsletter! Discover the latest updates, financial tips, community initiatives, and member highlights to help you achieve your goals. Explore how SOCU is making a difference for you and your community.

Read MoreWhen unexpected expenses arise, Service One Credit Union's Fast Cash offers a helpful solution. Providing $500-$2000 in readily accessible funds, this short-term loan helps bridge financial gaps between paychecks, covers urgent bills, and allows you to seize time-sensitive opportunities. By utilizing Fast Cash, you can prevent costly late fees and overdrafts, gaining crucial temporary financial relief when you need it most.

Read MoreBut before you hit the open road, being prepared for the RV loan process is key. Use this ultimate checklist to make your financing experience smooth and stress-free.

Read MoreHomeownership is one of the most significant investments many people make, and over time, that investment can grow in value. One of the best ways to tap into this value is through home equity. But what exactly can you do with home equity? From home improvements to consolidating debt, the possibilities are endless. In this guide, we'll explore various ways you can leverage your home equity to meet your financial goals.

Read MoreAre you a homeowner looking for ways to leverage the value of your property? Understanding home equity (sometimes called a second mortgage) is key to unlocking financial opportunities. Whether you're considering home improvements, consolidating debt, or planning for retirement, knowing how to tap into your home equity can be a game-changer. In this post, we'll break down what home equity is, how to calculate it, and how you can use it wisely.

Read MoreWhen it comes to your credit score, understanding the difference between hard and soft inquiries will give you more control over your finances. Learn the key differences between hard and soft inquiries, how they affect your credit score, when they are used, and tips to manage them responsibly.

Read MoreLooking to improve your credit score? You're not alone. At Service One Credit Union, our FREE credit counseling services are designed to help you take control of your finances and improve your credit score.

Read MoreBuying a car is an exciting milestone, but navigating the loan process doesn’t have to feel overwhelming. At Service One Credit Union (SOCU), we make financing simple and stress-free, so you can drive away with confidence. Whether you’re purchasing your first vehicle or upgrading to something new, here’s everything you need to know about securing an auto loan with SOCU.

Read MoreWhen it comes to borrowing money, understanding interest rates is crucial. Whether you're applying for a car loan, mortgage, or personal loan, the interest rate you receive significantly impacts how much you’ll ultimately pay back. As a member of Service One Credit Union, you have access to competitive rates and member-focused benefits. Let's break down interest rates and why credit unions like SOCU are a smart choice for your lending needs.

Read More