EFFORTLESS CREDIT MONITORING. POWERFUL RESULTS.

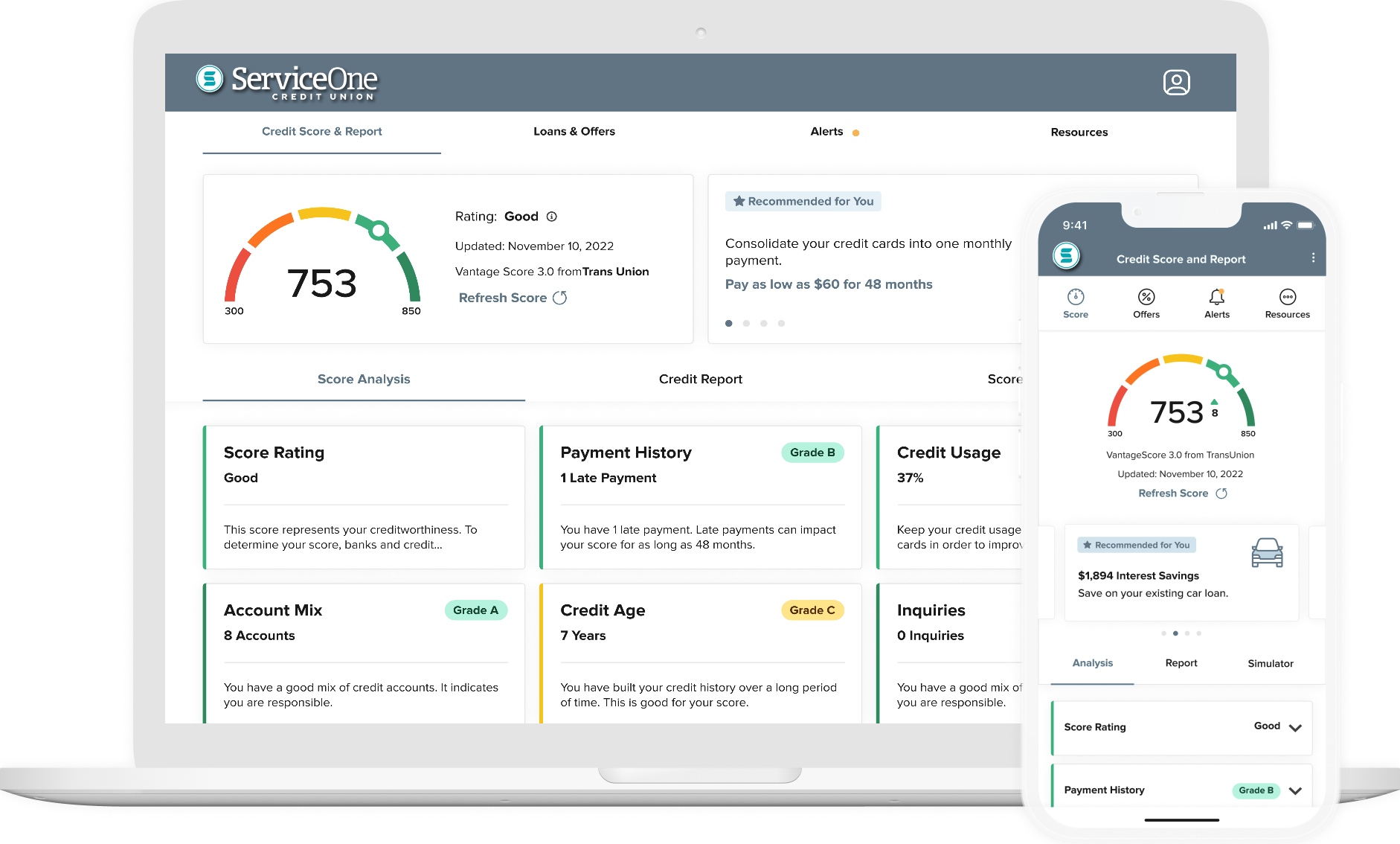

As a member, you get free access to a credit score tool right from your Service One online or mobile banking platform!*

This tool gives all of this, without impacting your credit score: estimated credit score, a full credit report, credit score goal tracker, and financial education just for you. The score you see is a guide to help you track your credit. **

You can do this ANYTIME and ANYWHERE and for FREE.

What You Get with this new tool

Free Access to Your Credit Score

View your updated VantageScore® from TransUnion with no impact to your credit.Real-Time Credit Monitoring

Get alerts when your score changes or when new activity hits your report.Personalized Tips & Insights

Learn how to improve your score with actionable steps tailored to your credit profile.Credit Score Simulator

Explore “what-if” scenarios—like paying off a credit card or taking out a loan—to see how they might impact your score.Pre-Qualified Offers

Receive Service One loan offers you’re eligible for—no hard inquiry required.

How to Get Started

Log in to your online banking or open the Service One mobile app

Tap on "Credit Score"

Instantly view your score and credit dashboard—free and secure

YOUR CREDIT SCORE. DAILY. AND SECURE.

Access your credit score and report in our mobile app and online banking.

Frequently Asked Questions

Will SOCU use this tool to make loan decisions

No. The score you see in the Credit Score Tool is a predictive and educational tool that is seperate from our official lending criteria.

This tool is provided to help you easily track and understand your credit, so you can find ways to improve your score over time.

What is this Credit Monitoring Tool?

Service One provides a free credit score and financial tool available through your Service One online and mobile banking. It gives you real-time access to your credit score, personalized financial tips, credit monitoring, and more—all without impacting your credit.

Is there a fee to use the Credit Score tool?

Nope! The Credit Score tool is completely free for Service One members who use online or mobile banking.

Will using the tool affect my credit score?

Not at all. Checking your score through the tool is considered a “soft pull,” so it won’t impact your credit.

How often is my credit score updated?

Your credit score and report are updated every seven days when you log in to your digital banking account.

Where can I find the Credit Score tool in digital banking?

You can access the Credit Score tool through the dashboard on your online banking or the mobile app. Just look for the "Credit Score” section.

What is included with this new Credit Score tool?

· Your VantageScore® from TransUnion

· A breakdown of what’s affecting your credit

· Alerts for changes to your credit report

· Credit score simulator

· Tips for improving your score

· Pre-qualified loan offers from Service One

Is my information secure?

Absolutely. This tool uses industry-standard encryption and security measures to keep your data safe and private.

What should I do if I see something incorrect on my credit report?

We provide tools through the online banking platform to help you identify errors and dispute them directly with TransUnion. You can also reach out to Service One for guidance.

How do I enroll?

Members are automatically enrolled, you don’t have to do any extra setup work.

How do I opt out of this?

1. Open the Credit Score tool and click “Resources”.

2. Find the “Profile Settings” and click “View Now”

3. Scroll to the very bottom and click on “Deactivate Credit Score Account.”

If you ever change your mind, ask a Service One associate to help you re-enroll.

Disclosures

*All members are automatically enrolled in the credit score tool, a free credit score and financial wellness tool available through Online Banking and the SOCU mobile app. Participation is optional and free, and it will not affect your other accounts or services.

You may opt out at any time by following these steps:

Open the Credit Score tool and click “Resources.”

Find “Profile Settings” and click “View Now.”

Scroll to the bottom and click “Deactivate Credit Score Account.”

If you change your mind later, a Service One associate can help you re-enroll in the credit score tool.

**Approximate score provided by VantageScore model, which is different from the FICO score. SOCU uses the FICO score to make any loan decisions.