Easy and Convenient Banking

View all your Service One Credit Union accounts whenever and wherever you want. Whether it's checking, savings, loans, or your Visa® Credit Cards, everything is conveniently organized for you in one place. Everything is designed with simplicity to save you time. Worried about security? Don't be! We've got you covered with top-notch encryption and layers of protection to keep your personal information safe.

How To Guides

Please see below for in depth how to guides for

how to manage your account.

Mobile Wallet

Use your smartphone or smartwatch to make purchases. Register your SOCU Debit and Credit Card to enable in mobile wallets.

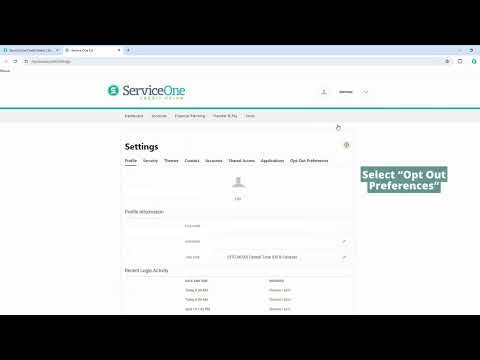

Online Banking + App Tutorials

How do I make a wire transfer?

Incoming Wire Instructions

Name of Bank: Service One Credit Union

City and State: Bowling Green KY

ABA Routing Number: 283978357

Beneficiary: Member's Name / Member's Full Account Number

Receiving Funds from an International Bank Members receiving money from a foreign bank may be asked to provide our SWIFT, BIC, IBAN, and CLABE number because foreign banks are accustomed

to using them. We do not have these numbers and they are not required to successfully wire money to us.

How do I log onto online banking for the first time?

You can register your account online using this link: https://mycu.socu.com/Registration

Upsell Section

Description of the Upsell Section.

Subject to membership requirements. All credit union programs, rates, terms and conditions are subject to change without notice.

Suggested Reading

As parents, we wear many hats: chef, chauffeur, storyteller, and increasingly, financial educator. Teaching our children about money management, saving, and smart spending is crucial for their future success. But where do you start? The good news is, you don't have to navigate this journey alone. Service One Credit Union offers a wealth of resources designed specifically to support your family's financial wellness, from their very first piggy bank to planning for college and beyond.

Let's explore some of the keyways Service One Credit Union can be your family's financial partner:

Homeownership is one of the most significant investments many people make, and over time, that investment can grow in value. One of the best ways to tap into this value is through home equity. But what exactly can you do with home equity? From home improvements to consolidating debt, the possibilities are endless. In this guide, we'll explore various ways you can leverage your home equity to meet your financial goals.

Are you a homeowner looking for ways to leverage the value of your property? Understanding home equity (sometimes called a second mortgage) is key to unlocking financial opportunities. Whether you're considering home improvements, consolidating debt, or planning for retirement, knowing how to tap into your home equity can be a game-changer. In this post, we'll break down what home equity is, how to calculate it, and how you can use it wisely.